5 Actions Every District Should Take Now

This page has not been updated since the President signed the latest federal budget reconciliation bill into law on July 4, 2025.

For updates, visit this page.

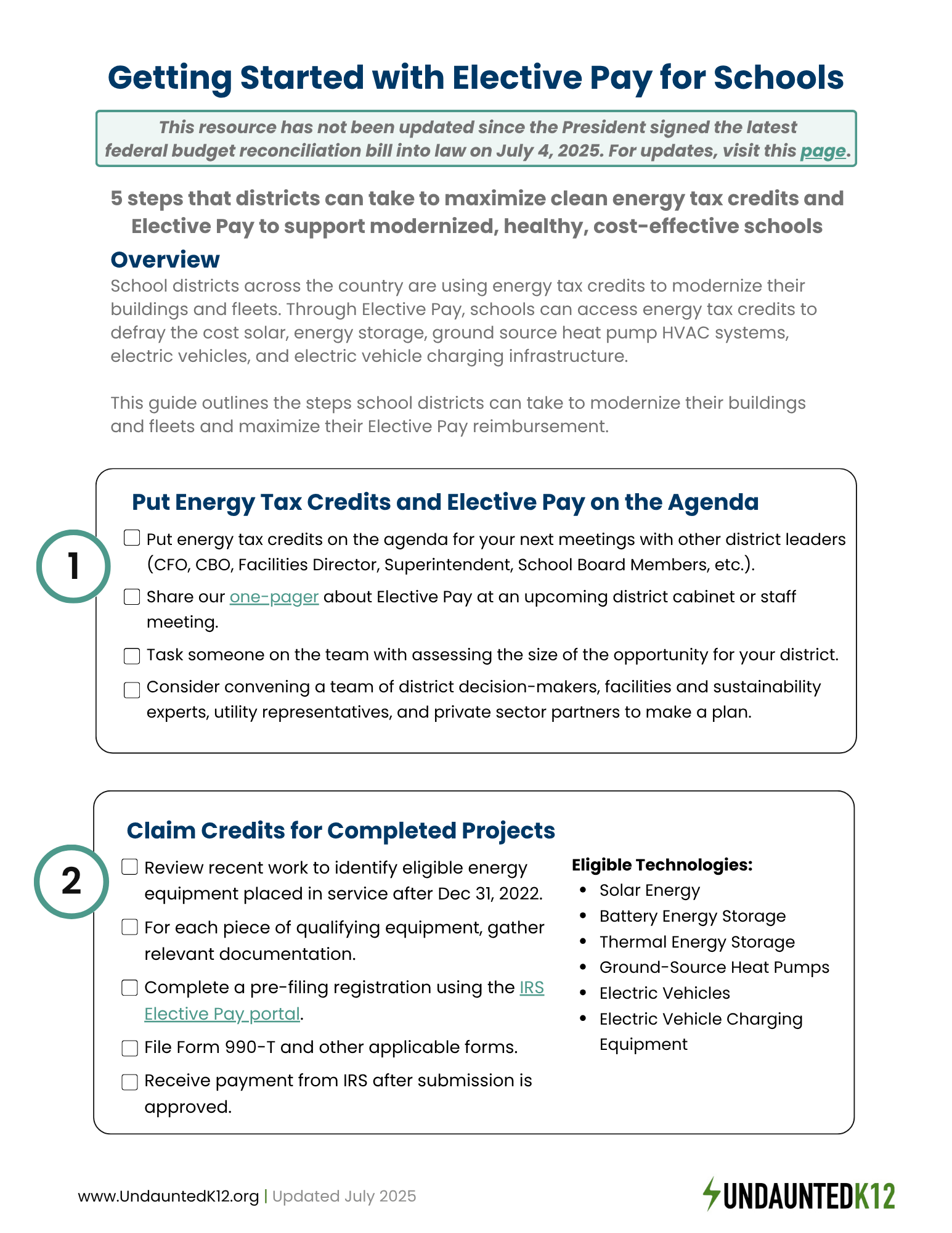

Below we recommend 5 action steps for every district to position itself to harness energy tax credits to support healthy, sustainable, resilient school facilities.

Put together your “Elective Pay team” and begin learning and sharing about the opportunities for your district (start here!). Initially, this might include your CFO and facilities director. Over time, the group might include Superintendents, members of your school board or school building committees, CFOs, CBOs, facilities managers, school and municipal sustainability leaders, utility representatives, and private sector entities with whom you partner on facilities design, construction, and decision-making. You may also want to identify a budget for professional services (tax counsel, accounting, energy credit experts, etc.) to support your district staff with claiming these energy tax credits.

If your school or district put certain clean energy equipment into service after December 31, 2022, you are likely eligible to claim clean energy tax credits.

To begin the reimbursement process, schools must pre-file with the Internal Revenue Service.

-

1) Complete the registration process electronically through the IRS elective pay portal

2) Satisfy the registration requirements and receive a registration number

3) Obtain a registration number for each qualified investment

4) Provide the specific information required to be provided as part of the pre-filing registration process including information about the taxpayer and about the qualified investment like its address and coordinates (longitude and latitude), supporting documentation, beginning of construction date, and placed in service date.

Review active projects to identify all qualifying clean energy equipment and understand what potential bonus credits might be applicable. Discuss current opportunities with all relevant project managers, designers, construction managers, and vendors. Determine what changes to current practices or plans need to be put into place to make best use of available clean energy tax credits (e.g. opting for domestically manufactured products, complying with labor standards).

Determine what current projects could be enhanced by opting for clean energy equipment. For example, do the available clean energy tax credits make ground-source heat pumps a more affordable choice than the more conventional gas boiler in a new construction project or planned HVAC system replacement? Using an integrated design process that evaluates potential investments in building systems, the building envelope, and energy sources could unlock savings over the lifetime of ownership while also being affordable on an upfront basis thanks to new clean energy tax credits.

Given the long time horizon over which these tax credits are available, districts should revisit their facilities master plans and capital plans through the lens of the Elective Pay funding opportunities.

Here are some activities to consider:

Hold strategic planning sessions and engage stakeholders about the new landscape and opportunities. Identify all “Energy Communities” within your district.

Invest in a Decarbonization Plan to understand how to sequence and incorporate clean energy machines into your district facilities through time. This Decarbonization Roadmap Guide for School Building Decision Makers can help guide your district through this work.

Connect with your utility to understand opportunities for financial and technical support on clean energy projects. For example, some utilities have partnered with school districts on electric school buses while others offer compensation to school districts for hosting energy storage.

Update relevant documents (RFQs, RFPs, contracts for design and construction professionals) to incorporate mention of energy tax credits and Elective Pay. Consider asking potential partners about their experience and capabilities in this area. Check out this procurement toolkit for high-performance buildings.

Engage local stakeholders about the opportunity for local funding to unlock additional federal resources. Your community’s local dollars will go farther and be matched with federal funds.

Consider how expected tax credits received for one piece of clean energy equipment could fund the next tax credit-eligible investment. For example, expected tax credits for ground-source heat pumps could be reinvested to install and own a solar energy system in the district.

Don’t miss out on this generational opportunity to support healthy, sustainable, resilient school facilities. These investments can benefit generations of students to come and support teaching and learning about climate solutions.

Let us know about your clean energy project and reach out to us with questions.