Solar & Storage: A New & Challenging Landscape

Understand how new rules may affect your school project

Schools across the country have embraced solar to reduce costs, but a July 2025 law makes significant changes that make it harder for schools to access tax credits. In many places, solar and storage remain compelling technologies for schools to evaluate despite the changes to tax credits.

See information and resources below to understand these changes, new rules, and how to manage projects under this changing environment.

Solar and storage projects are eligible for the Clean Electricity Investment Credit (Sec. 48E). The new rules affect solar and storage projects accessing the Sec. 48E tax credit.

In order to receive a tax credit, school districts must take action before the credit expires and they must meet the new Prohibited Foreign Entity (PFE) rules. For districts signing a Power Purchase Agreement (PPA), the PPA provider, as the tax filer, must manage these same factors.

Changes to Tax Credits for Solar Energy, Energy Storage, and Thermal Storage Projects

Changes Affecting Solar Energy Projects

Accelerated phase-out schedule:

Solar projects that begin construction by July 4, 2026, have 4 years to be placed into service to be eligible for the tax credit.

Solar projects that do not begin construction by July 4, 2026, must be placed into service by Dec 31, 2027 to be eligible for the tax credit.

New restrictions: Solar projects are subject to new Prohibited Foreign Entity (PFE) rules.

New guidelines: New Beginning of Construction (BOC) guidelines only apply to solar projects greater than 1.5 megawatts (MW) and therefore, are unlikely to affect schools. Please consult a qualified tax professional to confirm whether these new guidelines apply to your project.

No changes to the phase-out schedule:

Energy storage and thermal storage projects must begin construction by Dec 31, 2035 to be eligible for the tax credit.

The credit is reduced for projects beginning construction in 2034 and 2035.

100% of credit amount is available through CY2033

75% of credit amount is available in CY2034

50% of credit amount is available in CY2035

0% of credit amount is available in CY2036

New restrictions: Storage projects are subject to new Prohibited Foreign Entity (PFE) rules.

Changes Affecting Energy Storage & Thermal Storage Projects

Prohibited Foreign Entity (PFE) Rules

Solar and storage projects accessing Sec 48E are subject to new Prohibited Foreign Entity (PFE) rules (or “Foreign Entity of Concern (FEOC)” rules).

These rules address the sourcing of materials used in the project and other transactions to which school districts are a party (e.g. municipal debt issuances, licensing agreements).

Schools planning to claim Sec 48E (or for districts signing a power purchase agreement, the PPA provider) will have to contend with these new rules.

On Feb 12, 2026, IRS released interim guidance (Notice 2026-15) that provides details relevant to the material assistance test – specifically information to determine whether a project meets the minimum threshold of direct costs that are not tied to Prohibited Foreign Entities.

Projects beginning construction after Dec 31, 2025 must meet this test to claim the credit.

Districts starting projects in 2026 should ensure their developers understand this guidance as they procure equipment.

This guidance does not address the entity-level test and the payments test. Additional guidance is forthcoming.

Video: Solar and Storage Projects (Dec 2025)

Watch this short and digestible video to understand the rules and what steps you can take to navigate this new landscape.

Please note this video was recorded before the IRS released interim guidance on PFE rules (Notice 2026-15) on Feb 12, 2026. While it remains accurate, it does not cover the details in this guidance.

Upcoming Webinar: Understand the Latest IRS Notice on PFE

March 12 at 3pm ET

Lawyers For Good Government will explain new interim guidance on PFE rules (Notice 2026-15). Understand how this guidance may impact your project and ask your questions.

Does Your District Have a Path to Claim the Sec 48E Credit?

Solar and storage projects remain a great option for schools. Schools planning to claim the Sec 48E tax credit for these projects should set expectations around whether they have a path to claim federal tax credits in this new landscape.

School districts can ask themselves these questions to help determine their ability to claim the credit. Watch this video for helpful context.

Credit Expiration: Can we commence construction by July 4, 2026 or place into service by Dec 31, 2027?

Material Assistance Test: Can we pass the Material Assistance Test? Or did we commence construction by Dec 31, 2025?

Entity-Level Test: Can we pass the Entity Test? Or can we place into service before the end of the taxable year containing July 4, 2025?

Payments Test: Can we avoid contracts related to the energy property that confer “effective control” to a Specified Foreign Entity (SFE)?

Schools that commenced construction by Dec 31, 2025 and place systems into service by June 30, 2026 (assuming a July 1 - June 30 fiscal year) can receive full credit and avoid the Material Assistance Test and Entity Test.

However, any solar or storage projects commencing construction after Dec 31, 2024 should be prepared to navigate the new Payments Test.

Example Procurement Language for PFE Compliance

School districts pursuing solar and storage projects and planning to claim the Sec 48E tax credit should select private partners that can deliver projects in compliance with Prohibited Foreign Entity (PFE) rules and support the district in claiming the credit.

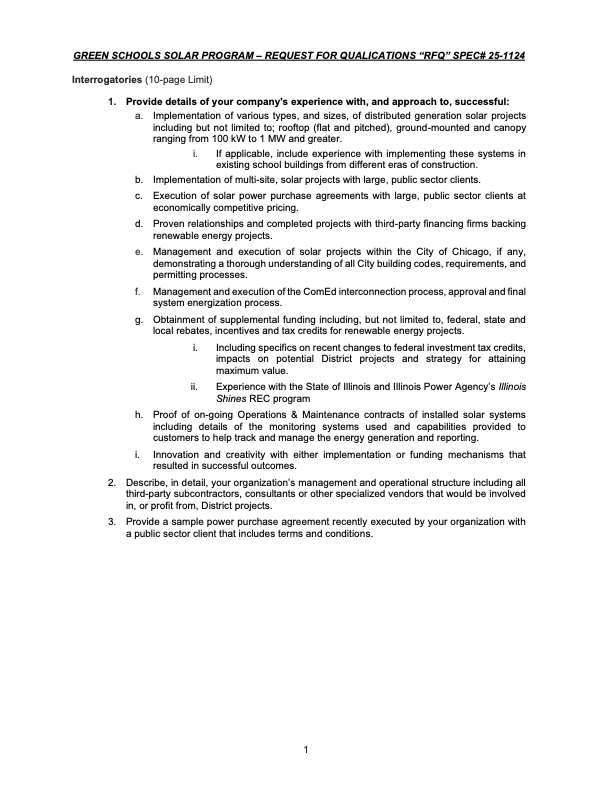

This need can be specified in procurement documents. See example language below in Chicago Public Schools’ Green Schools Solar Program Request for Proposals (RFP).

“Pursuit and successful receipt of… the federal investment tax credits… Ensuring that all projects… include the necessary details, and specifications… to qualify for… tax credits.”

See this text and more here.

“...Including specifics on recent changes to federal investment tax credits, impacts on potential District projects and strategy for attaining maximum value.”

See this text and more here.

Webinar: PFE Compliance: BABA, Domestic Content, and PFE Material Assistance (Jan 2026)

Solar and storage projects planning to claim the Sec 48E tax credit and funded by other federal funds may be subject to multiple, partially overlapping product sourcing requirements: the Prohibited Foreign Entity (PFE) rules, domestic content requirements, and Build America Buy America (BABA) requirements.

This webinar walks through these requirements, addresses miconceptions, how to simultaneously satisfy them if necessary.

Additional Resources for Tax-Filing Support

We Build Progress & Lawyers for Good Government (L4GG) Monthly Elective Pay Office Hours

Thursday, March 12 at 1pm ET

We Build Progress and L4GG host monthly office hours on Elective Pay. Share your clean energy project project plans, talk through roadblocks, and ask your questions.

Internal Revenue Service (IRS) Monthly Elective Pay Office Hours

Wednesday, March 18 at 1pm ET

The IRS hosts monthly office hours dedicated to Elective Pay and energy tax credits. Attend to ask your questions. See dates scheduled through 2026.

L4GG has launched the Elective Pay Sprint Hub to help entities maximize energy tax credits while they are still available. Complete the intake form and receive assistance for your project.

Additional Information:

NYU Tax Law Center: Navigating OBBBA: phaseouts, prohibited foreign entity rules, and other new rules

NYU Tax Law Center: Summary of Prohibited Foreign Entity (PFE) Rules (48E/45Y/45X only)

Lawyers for Good Government: Guidance Brief on Beginning of Construction for the 48E and 45Y Tax Credits

NYU Tax Law Center: Treasury releases much-anticipated beginning of construction guidance for solar and wind

IRS: Prevailing Wage & Apprenticeship Overview and FAQs about PWA

U.S. Department of Labor: Prevailing Wage Guidance

IRS: Clean Electricity Low-Income Communities Bonus Credit Amount Program

Baker Tilly: Energy Communities Map

Questions? Reach out to us at: info@undauntedk12.org.

The information on this page represents our best understanding of certain tax provisions for general informational purposes only and is not itself tax guidance. Please consult qualified tax professionals about your specific circumstances and refer to guidance issued by the IRS for detailed information on the rules associated with energy tax credits, elective pay, and other relevant tax provisions.