How are school districts funding critical facilities upgrades? Leaders in MI, KY, and WI share their strategies at ASBO International

Upgrading school facilities is essential for creating safe, efficient, and resilient learning environments. Funding these critical projects can be a challenge. This October, at ASBO International’s Conference and Expo, Undaunted’s voice was part of two informative sessions alongside school district leaders who have successfully leveraged federal energy tax credits and Elective Pay to make transformative projects possible in their districts.

Pulaski County Schools in Kentucky received a $1.83 million reimbursement from the IRS for ground-source heat pumps at Oak Hill and Shopville Elementary Schools. Superintendent Patrick Richardson shared how they financed the project through energy tax credits and a guaranteed energy savings performance contract (ESPC) with Louisville-based construction and engineering firm CMTA.

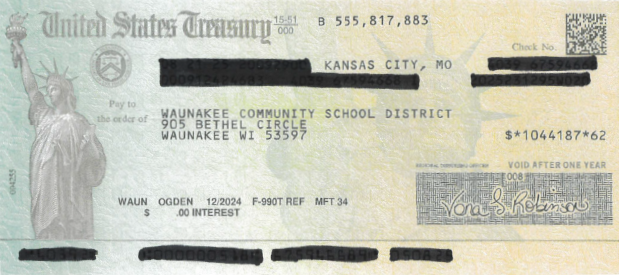

Waunakee Community School District in Wisconsin received a $1,044,188 reimbursement for clean energy technologies installed at Waunakee Intermediate School and the new Heritage Elementary Schools. Facilities Director Steve Summers shared how, after learning about the opportunity to claim energy tax credits through Elective Pay during a WASBO presentation in March 2024, his team worked with Wipfli, Vogel Brothers Construction, and legal advisors to maximize the opportunity for their district.

Ida Public Schools in Michigan expects a $3.12M reimbursement for a ground-source heat pump replacing a 49-year old gas boiler system at Junior/Senior High School. During the session, Superintendent David Eack shared how the energy tax credits became the critical lever that allowed the district to move forward after two failed bond measures. After the bond measures failed, he proposed an eight-year “sinking fund” to replace the aging HVAC system with a ground-source heat pump, emphasizing how the system would deliver low-cost heating and cooling to the buildings, and would lower the project costs by 40% by qualifying for the energy tax credit.

We’re grateful to these district leaders for joining us in demonstrating how through careful planning, strong partnerships, and strategic use of federal incentives and financing strategies, school districts can invest in modernized, energy-efficient infrastructure that will bring benefit to their students, staff, and school communities for decades.

Want to learn more about energy tax credits and performance contracting? Check out this webinar hosted by UndauntedK12 and the BASIC Coalition.